Bitcoin’s Four-Year Cycle: What History Tells Us About 2026

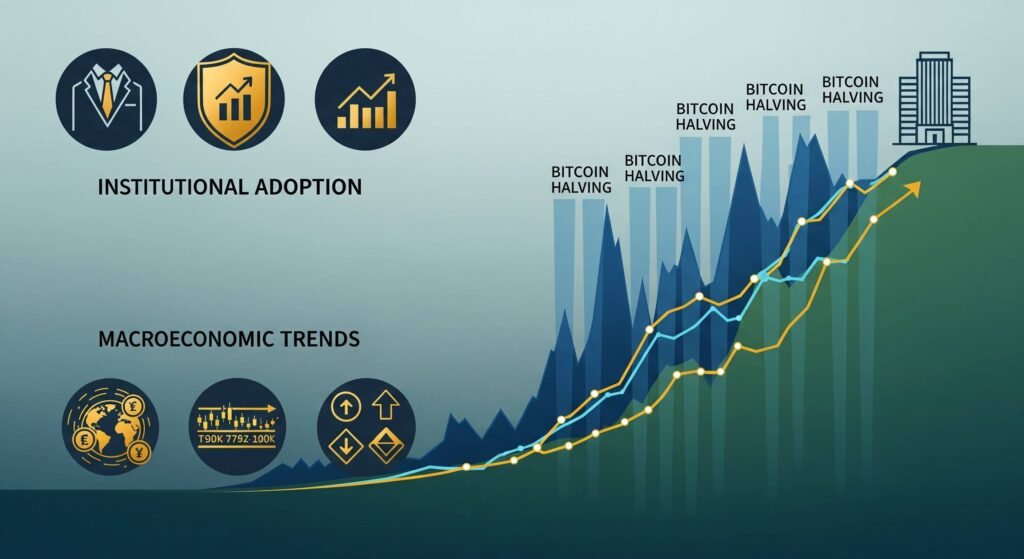

Bitcoin’s price movements aren’t just random. They’re often tied to a four-year cycle driven by a programmed event called the halving. Every four years, the reward for mining a new block is cut in half, reducing the supply of new Bitcoin entering the market. Historically, these halvings have set the stage for major price rallies, with peak prices typically following 12 to 18 months later.

While the 2024 halving has already occurred, the outcome for 2026 is far from certain. The halving reduces supply, but it’s demand that fuels the rally. This demand is influenced by several external factors.

The Big Drivers of Bitcoin’s Price

Past bull runs were powered by key market movers, and these same forces will shape the path to 2026:

Institutional Adoption: The introduction of tools like Bitcoin ETFs and futures markets has brought large, institutional investors into the crypto space, lending legitimacy and significant capital to the market.

Regulatory Shifts: Clear regulatory guidance can foster growth, while unexpected legal actions or bans can trigger sharp sell-offs. The regulatory landscape in the U.S., EU, and Asia will be a major factor.

Macroeconomic Trends: Broader economic conditions, such as interest rates and inflation, directly impact investor risk appetite. A favorable economic environment with lower interest rates tends to boost crypto prices, while a restrictive one can have the opposite effect.

Technological & Security Events: Major security breaches or technological upgrades can either shake or bolster market confidence.

Key Trends to Watch on the Road to 2026

As Bitcoin enters the post-2024 halving phase, three key trends are likely to dominate the narrative:

ETF Inflows: Continued, strong inflows into new spot Bitcoin ETFs could provide a steady and powerful source of demand.

Regulatory Clarity: Clearer rules from global regulators will either open doors for new capital or create barriers.

Federal Reserve Policy: The Federal Reserve’s decisions on interest rates and monetary policy are likely to be the single biggest external influence on the market’s direction.

Bitcoin Price Predictions for 2026

Analysts have offered a range of forecasts for where Bitcoin could land by 2026, though all should be viewed with caution:

Conservative Forecast ($80k–$120k): This scenario assumes steady institutional adoption but a mixed or unfavorable macroeconomic environment.

Bullish Forecast ($200k+): This prediction relies on sustained, strong ETF inflows and favorable macroeconomic conditions.

Bearish Forecast ($40k–$60k): This outcome could be triggered by major regulatory crackdowns or a significant economic recession.

While models like Stock-to-Flow and on-chain metrics can provide valuable insights, they often fail to account for unforeseen market changes. The most reliable approach is to consider multiple indicators in the context of real-world events.

Risks That Could Disrupt the Cycle

Even the most optimistic forecasts could be derailed by “black swan” events. These wild cards include:

Sudden global regulatory crackdowns.

Major exchange hacks or insolvencies.

A prolonged global economic recession.

Geopolitical instability and conflict.

The bottom line: While history suggests a bullish period for Bitcoin into 2026, the final outcome will be a complex blend of supply dynamics, demand drivers, and external risks. Investors should prepare for a range of possibilities, not just the one they hope for.