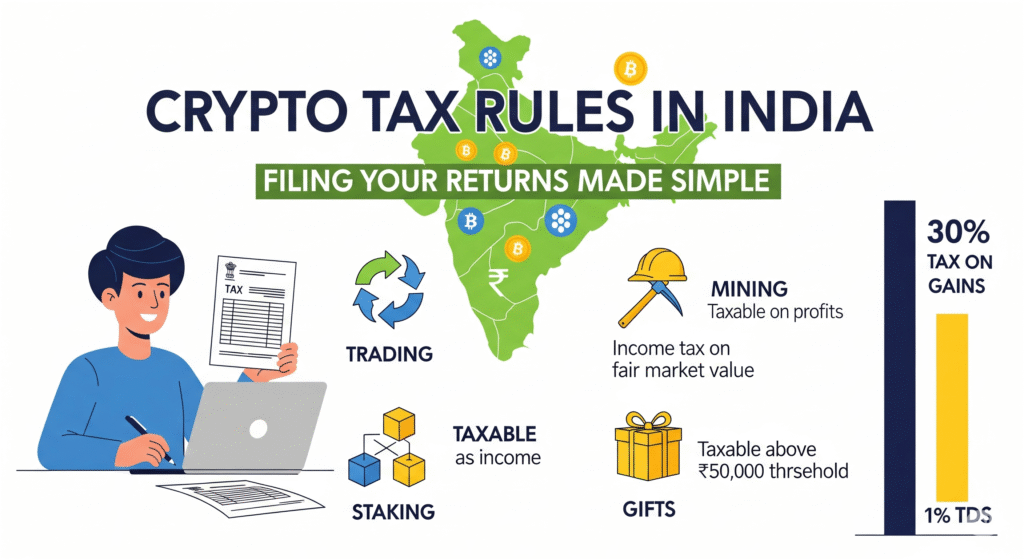

Yes — if you’re trading, selling, or even gifting crypto in India, the Income Tax Department wants its share.

Since 2022, the Indian government has formalized the taxation of Virtual Digital Assets (VDAs), including Bitcoin, Ethereum, NFTs, and more. But many investors are still confused about how to calculate, report, and pay crypto taxes.

In this guide, we simplify it all for you.

Key Crypto Tax Rules in India (As of FY 2025–26)

Key Crypto Tax Rules in India (As of FY 2025–26)

| Rule | Description |

|---|---|

| Flat 30% Tax | On profits made from transfer/sale of any crypto |

| 1% TDS (Tax Deducted at Source) | On every crypto transaction above ₹10,000 |

| No Loss Set-Off | Crypto losses cannot offset gains from other assets |

| Gifting Rule | Crypto gifts above ₹50,000 are taxable in the hands of the recipient |

How to Calculate Crypto Tax

How to Calculate Crypto Tax

Crypto Profit = Selling Price – Purchase Cost

Tax Payable = 30% of Crypto Profit

-

Bought 1 ETH for ₹1,20,000

-

Sold at ₹1,80,000

-

Profit: ₹60,000

-

Tax: ₹18,000 (30% of 60K)

Where to Report in ITR (Income Tax Return)

Where to Report in ITR (Income Tax Return)

If you’re an individual or freelancer, use:

-

ITR-2 or ITR-3

-

Report under “Income from Other Sources”

-

Mention crypto profits and TDS deducted under relevant schedules

What About 1% TDS on Crypto?

What About 1% TDS on Crypto?

-

Exchanges like CoinDCX, WazirX, CoinSwitch automatically deduct it.

-

You can claim TDS in Form 26AS while filing your ITR.

-

If you’re using foreign exchanges (Binance, KuCoin), you may need to deduct and pay 1% TDS yourself.

What If You Don’t File Crypto Taxes?

What If You Don’t File Crypto Taxes?

Avoid it — file on time and stay clean.

How to File Crypto Tax – Step-by-Step

How to File Crypto Tax – Step-by-Step

-

Track all trades (buy/sell/gift/receive)

-

Use tax calculators like KoinX, ClearTax Crypto, or CoinLedger

-

Add crypto income in ITR-2 or ITR-3

-

Include TDS details (Form 26AS)

-

E-verify and submit ITR before the deadline

Important Dates

Important Dates

-

TDS Return Filing Deadline (Quarterly): 31st of July, Oct, Jan, and May

-

ITR Filing Deadline (FY 2024–25): July 31, 2025

Pro Tips for Crypto Investors

Pro Tips for Crypto Investors

-

Keep clean records of all trades and wallets

-

Avoid peer-to-peer untracked transactions

-

Choose Indian exchanges that comply with TDS

-

Don’t try to “hide” — exchanges already report your data to tax authorities

Tools to Simplify Filing

Tools to Simplify Filing

| Tool | Features |

|---|---|

| KoinX | Indian-specific crypto tax reports |

| Cleartax Crypto | Auto-imports from exchanges |

| Zerodha Quicko | Integrates with CoinSwitch, WazirX |

| CoinTracker | Great for global users with NFTs |

Conclusion: Filing Crypto Tax in India Is Now Easier Than Ever

Conclusion: Filing Crypto Tax in India Is Now Easier Than Ever

Crypto is no longer in a legal gray area in India — it’s fully taxed, and the rules are clear.